By dividing the total fixed costs by the contribution margin per unit, the break-even point in units can be determined. This figure indicates the number of units that must be sold to cover all costs. Companies have many types of fixed costs including salaries, insurance, and depreciation.

- The margin of safety is the difference between a company’s intrinsic value (its estimated 10-year cash flow minus inflation) and the current stock price.

- For example, if a stock has an intrinsic value of $50 per share based on these factors but is trading at $40 per share, the margin of safety is calculated as $10 per share.

- By taking a margin of safety into account when making investment decisions, investors can ensure they don’t overpay for an asset.

- Essentially, to utilize the margin of safety like its pioneers intended, you’d have to buy a stock at a huge discount.

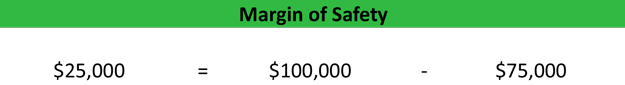

Example of Calculating Margin of Safety

A margin of safety, as it relates to investing, gives investors an idea of how much margin of error they have when evaluating investments. Making profitable investment decisions is largely about investment risk management. The risk involved in a trade needs to be balanced with the potential reward. In financial markets, taking greater risks often gives the potential for greater rewards but also for greater losses — a concept known as the risk-reward ratio. Similarly, in the breakeven analysis of accounting, the margin of safety calculation helps to determine how much output or sales level can fall before a business begins to record losses.

Our Services

These equations simply help you estimate an optimal quantity of safety inventory that aligns with your business needs. The demand rate for the shoes also varies between 150 and 190 pairs per day. You can see property tax deduction definition the frequency and probability of the demand rate that you can calculate in the same way as in lead time. Lead time variability refers to how consistent or unpredictable your supplier’s delivery times are.

Discover more from Accounting Professor.org

Margin of safety is a concept in accounting and finance that measures the difference between the current level of sales and the break-even point. The break-even point is the level of sales that covers all the fixed and variable costs of a business. The margin of safety indicates how much sales can drop before the business starts to lose money. It’s important for businesses to accurately calculate variable costs to determine their contribution margin – the amount of revenue left over after variable costs are subtracted. This information can help businesses set pricing strategies, understand how changes in production levels will impact profitability, and identify opportunities for cost reduction.

It is an important number for any business because it tells management how much reduction in revenue will result in break-even. You might wonder why the grocery industry is not comparable to other big-box retailers such as hardware or large sporting goods stores. Just like other big-box retailers, the grocery industry has a similar product mix, carrying a vast of number of name brands as well as house brands.

Ask Any Financial Question

The margin of safety of Noor enterprises is $45,000 for the moth of June. It means if $45,000 in sales revenue is lost, the profit will be zero and every dollar lost in addition to $45,000 will contribute towards loss. Businesses use this margin of safety calculation to analyse their inventory and consider the security of their products and services. You can also use the formula to work out the safety zones of different company departments. It’s useful for evaluating the risk of the different services and products you sell.

Managers can utilize the margin of safety to know how much sales can decrease before the company or a project becomes unprofitable. Margin of safety is a principle of investing in which an investor only purchases securities when their market price is significantly below their intrinsic value. In other words, when the market price of a security is significantly below your estimation of its intrinsic value, the difference is the margin of safety. The margin of safety formula provides a way for investors to calculate a safe price at which to buy a security. According to value investing principles, stocks have an intrinsic value and a market value.

In fact, comparing growth investing and value investing is sort of like comparing apples to oranges. But the fact remains—this is a lens that can only be used to gauge the quality of a certain type of stock, so it is a bit inflexible and lacking overall. Right—now that we’ve dealt with the basics, let’s move on to something that’s a bit more practical. Although the margin of safety as a concept has fallen out of fashion as of late, it’s actually deeply tied to the origin of value investing as we know it today. However, one thing is certain—the larger the margin of safety, the longer it will take to realize your profits. If you’re not in a rush, this is great—Warren Buffet, for example, looks to buy stocks at as much as a 50% discount if possible.

Leave a Reply